The Weighting of Commodities

This blog explores the hard part of weighting commodities, the historical cycles, and the epic buying opportunity that may arise between now and 2030. It also suggests that around 2025-2027, the 10-year return to commodities will be zero.

Michael Green

Chief Strategist Simplify Asset Management | PM of $FIG | not investment advice

-

1/n The weighting is the HARDest part. Let’s take this “bullish” response to @hkuppy ‘s interesting thread at face value https://t.co/1qwW2bTimo

— Michael Green (@profplum99) March 28, 2023 -

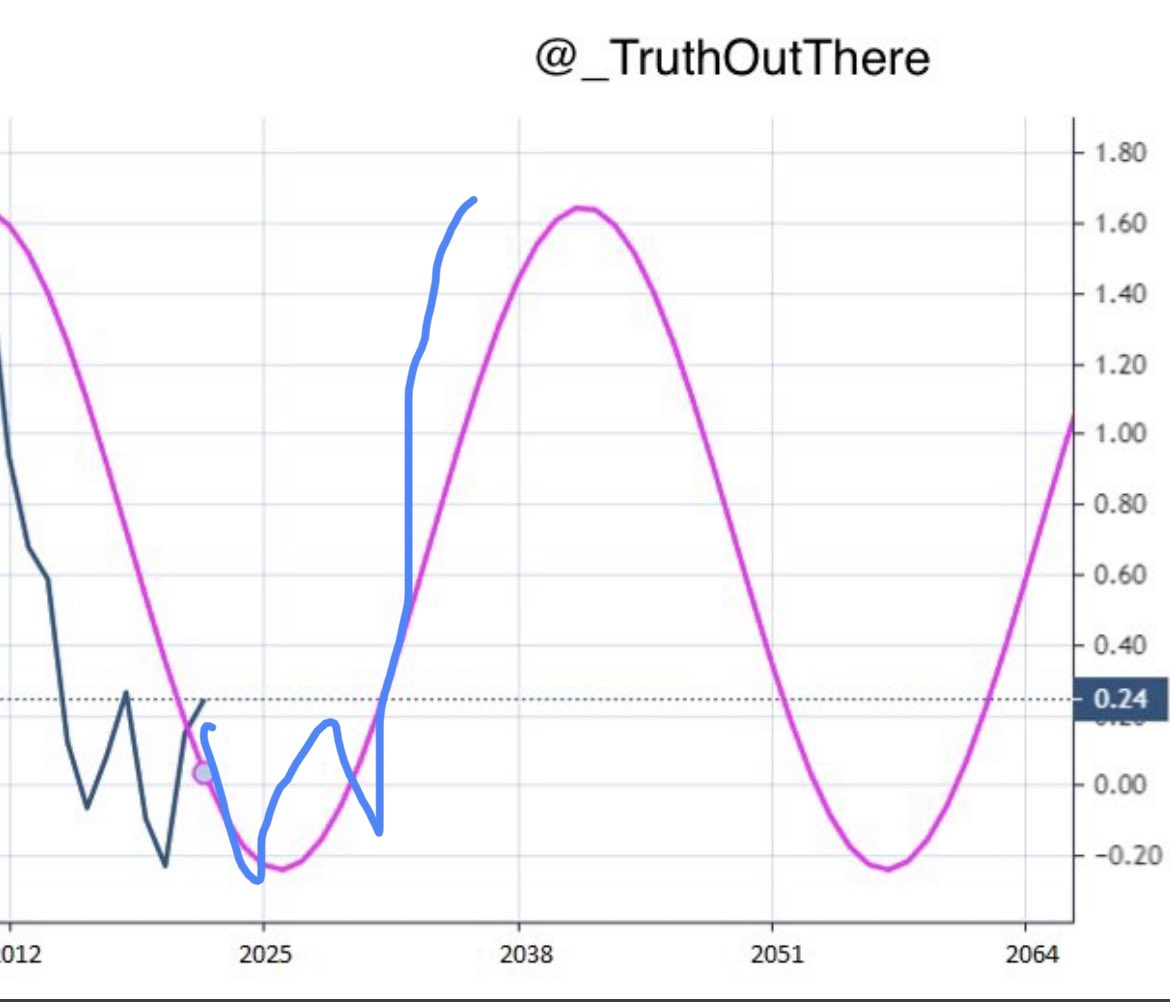

2/n Assuming the historical cycles hold, sometime between now and 2030 there will be an epic buying opportunity in commodities. But before we get there, it’s likely to look something like this. pic.twitter.com/IY7TkJS2l6

— Michael Green (@profplum99) March 28, 2023 -

3/n That suggests that somewhere around 2025-2027, the “expected” (based on semi-random lines on a chart) 10yr return to commodities will be zero. From 2015 to 2017 the average level of the CRB was ~400. It’s currently ~547. So the bullish read is that the CRB falls 27% over pic.twitter.com/OZRhGmhf7c

— Michael Green (@profplum99) March 28, 2023 -

4/n the next 2-4 years? I’m not suggesting commodities are a bad investment, in fact I think these charts are directionally correct and I have a bias higher as well when the Fed cuts (although I’d guess that’s a fade into global recession). But remember that this entire data

— Michael Green (@profplum99) March 28, 2023 -

5/n series is contained within a much larger cycle and we have no real idea what commodities do in a world of slowing, possibly negative population growth https://t.co/3qQW8lXsNj pic.twitter.com/uN18rIwWDD

— Michael Green (@profplum99) March 28, 2023 -

6/6 Which is why HODLing the CRB is unlikely to bear fruit even as you SHOULD figure out a way of gaining exposure. Early is wrong, but late is dead. Excited that you can join @CMcgarraugh and the @SimplifyAsstMgt team in our approach. pic.twitter.com/HRQl7MvdJQ

— Michael Green (@profplum99) March 28, 2023