The Week in Charts: A Pause at Last

The S&P 500 is off to its best start to a year since 1997, up over 15%. Wall Street strategists were not expecting a great year for stocks entering 2021. Learn more about the latest stock market trends.

Charlie Bilello

Chief Market Strategist @ Creative Planning Investor | Writer | Reader | Thinker Trying to become a little wiser every day.

-

New: The Week in Charts ‼

— Charlie Bilello (@charliebilello) June 16, 2023

-- Just Like Nobody Predicted

-- A Pause at Last

-- Down Goes Inflation

-- What About Japan?

-- The Consumer Pullback

-- And more...

📺:https://t.co/kfPic5mQrA -

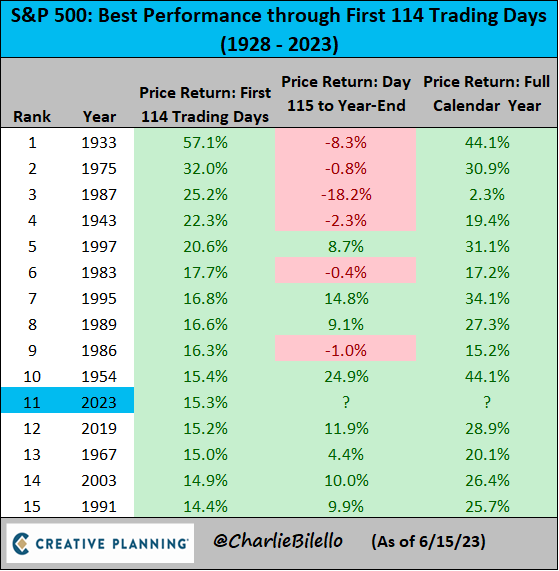

(1) Best Start Since 1997

— Charlie Bilello (@charliebilello) June 19, 2023

The S&P 500 is off to its best start to a year since 1997, up over 15%. $SPX

Video: https://t.co/KvJXij82lf pic.twitter.com/aeSSXt5v7D -

(1a) Just Like Nobody Predicted

— Charlie Bilello (@charliebilello) June 19, 2023

Were the experts predicting a great year for stocks? Not exactly. Entering 2023, Wall Street strategists were actually forecasting a down year for the first time in decades.

Video: https://t.co/KvJXij82lf pic.twitter.com/mqMovWizDV -

(1b) 27% Rally Brings Out the Bulls

— Charlie Bilello (@charliebilello) June 19, 2023

The S&P 500 has rallied 27% from its October low and optimism is back in the air. Bulls outnumbered Bears by 22% in the latest AAII sentiment poll, the largest spread since November 2021.

Video: https://t.co/KvJXij82lf pic.twitter.com/yePhhsCJvW -

(1c) New High for Tech

— Charlie Bilello (@charliebilello) June 19, 2023

The Tech sector ($XLK ETF) hit a new all-time high last week, surpassing the December 2021 peak (note: total return, including dividends).

Video: https://t.co/KvJXij82lf pic.twitter.com/tpZj1HPNkG -

(2) A Pause at Last

— Charlie Bilello (@charliebilello) June 19, 2023

After 10 consecutive meetings with rate hikes, the Fed finally decided to pause, holding the Fed Funds Rate at a range of 5.00-5.25%.

Video: https://t.co/n8XVFJES2J pic.twitter.com/mzo8AbzENW -

(2a) Tightest Monetary Policy Since 2007

— Charlie Bilello (@charliebilello) June 19, 2023

The Fed Funds Rate is now over 1% higher than the US inflation rate. The last time monetary policy was this tight with a Fed Funds Rate above 0% was back in October 2007.

Video: https://t.co/n8XVFJES2J pic.twitter.com/CDZGxqPJKx -

(2b) One More Hike in July?

— Charlie Bilello (@charliebilello) June 20, 2023

The market is currently pricing in just one more rate hike, and for that hike to take place in July (74% probability). After that, a pause is expected for the remainder of the year w/ rate cuts starting in Jan 2024.

Video: https://t.co/n8XVFJES2J pic.twitter.com/g10ZTQH4Hg -

(3) Down Goes Inflation

— Charlie Bilello (@charliebilello) June 20, 2023

-CPI moved down to 4% in May, lowest since March 2021.

-PPI moved down to 1.1% in May, lowest since December 2020.

-US Import Prices fell 5.9% over the last year, the largest YoY decline since May 2020.

Video: https://t.co/3JXEmkpGeA pic.twitter.com/ulTGI4OJj3 -

(3a) Back on the Path to Prosperity

— Charlie Bilello (@charliebilello) June 21, 2023

US wages outpaced inflation on a YoY basis in May by 0.2%, ending the ignominious streak of 25 consecutive months of negative real wage growth.

Video: https://t.co/3JXEmkpGeA pic.twitter.com/pBvKLoVr1j -

(4) Valuation Matters

— Charlie Bilello (@charliebilello) June 21, 2023

Japan’s CAPE ratio was a sky-high 77 in Dec 1989, making the US dot-com bubble look tame by comparison (peak CAPE ratio of 47). More than 33 years later, after an 82% drawdown, the Nikkei is still below its bubble peak.

Video: https://t.co/qRjnmp244i pic.twitter.com/cUXcxFJAGE -

(5) US Consumer Is Pulling Back

— Charlie Bilello (@charliebilello) June 21, 2023

After adjusting for inflation, US retail sales fell 3.3% over the last year, the 7th consecutive YoY decline. That’s the longest down streak since 2009.

Video: https://t.co/SxMJ49yW32 pic.twitter.com/ZK38nzh1VV