The Week in Charts: Government Spending, Dollar Devaluation, and the Next Generation

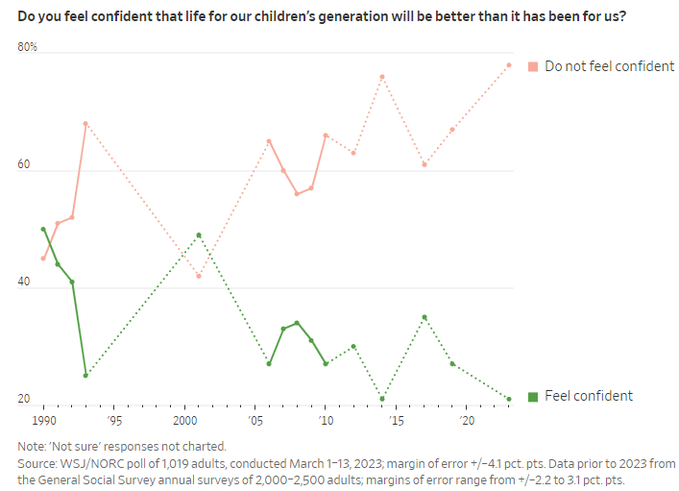

This video discusses three charts: US Federal Government Spending has increased 185% over the last 20 years, the purchasing power of the US dollar has decreased over the last 20 years, and 78% of Americans surveyed by the Wall Street Journal said they don’t feel confident that life for their children’s generation will be better than their own.

Charlie Bilello

Chief Market Strategist @ Creative Planning Investor | Writer | Reader | Thinker Trying to become a little wiser every day.

-

New Video:

— Charlie Bilello (@charliebilello) April 7, 2023

The Week in Charts...https://t.co/karfdHioFS -

(1) The Next Generation

— Charlie Bilello (@charliebilello) April 8, 2023

78% of Americans surveyed by the Wall Street Journal said they don’t feel confident that life for their children’s generation will be better than their own, the highest % since the survey began asking the question in 1990.

Video: https://t.co/HsE33M1T0e pic.twitter.com/xQ85TNEyaz -

(1b) Government Spending Binge

— Charlie Bilello (@charliebilello) April 8, 2023

US Federal Government Spending has increased 185% over the last 20 years versus a 64% increase in overall inflation (CPI).

Video: https://t.co/HsE33M1T0e pic.twitter.com/d6luJVz8d6 -

(1c) Dollar Devaluation

— Charlie Bilello (@charliebilello) April 8, 2023

Over the last 20 years, the purchasing power of the US Dollar has declined 39%.

Video: https://t.co/HsE33M1T0e pic.twitter.com/7dwH2u8Wbc -

(2) M2 Moving Lower

— Charlie Bilello (@charliebilello) April 8, 2023

The US Money Supply continued to contract in February and is now down 2.4% year-over-year. That’s the largest 12-month decline on record with data going back to 1959.

Video: https://t.co/PkJRq91Erh pic.twitter.com/pWK2K5U5Yy -

(3) Housing Market Repricing

— Charlie Bilello (@charliebilello) April 8, 2023

US Home Prices fell in January for the 7th consecutive month (case shiller national index). The 5.1% decline over the last 7 months is the largest 7-month decline since 2011-12.

Video: https://t.co/Wj5lL5cE9n pic.twitter.com/vUKKQINE4V -

(4) Reducing Rents

— Charlie Bilello (@charliebilello) April 8, 2023

US Rents are 2.7% higher than last year, the smallest increase since April 2021. Meanwhile, vacancy rates have risen to their highest level in 2 years and a record number of multi-family units are currently under construction.

Video: https://t.co/X8iVZsFvrQ pic.twitter.com/Eft603lt7W -

(5) Falling Inflation Expectations

— Charlie Bilello (@charliebilello) April 8, 2023

-1-Year ahead consumer inflation expectations have moved down to 4.2%, lowest since May 2021.

-3-Year ahead inflation expectations are down to 2.7%, the lowest since June 2020.

Video: https://t.co/RLjEn5o83F pic.twitter.com/FGsSy8O5B0 -

(6) Summer Ease?

— Charlie Bilello (@charliebilello) April 8, 2023

The market is now expecting another 25 bps rate hike in May (to 5.00-5.25%), but then a 180 degree shift to rate cuts starting in July. By the end of 2024, the market is saying that the Fed will cut rates back below 3%.

Video: https://t.co/CFv0v7Gwi5 pic.twitter.com/N45FuCObk7 -

(7) The Manufacturing Recession

— Charlie Bilello (@charliebilello) April 8, 2023

The last 3 times ISM Manufacturing was this low, the US economy was in or about to be in a recession. You have to go back to 1995-96 to find a lower reading with no recession.

Video: https://t.co/Dqvw1rUMOc pic.twitter.com/yULeAI4bk6 -

(8) More Jobs Growth, Fewer Job Openings

— Charlie Bilello (@charliebilello) April 10, 2023

The March jobs report showed the 27th consecutive month of gains. The number of US Job Openings fell to 9.9 million in February, the fewest since May 2021 and a noticeable decline from last month.

Video: https://t.co/xLPMinVlCU pic.twitter.com/WWYWcY8dKg -

(9) The Money Market Boom

— Charlie Bilello (@charliebilello) April 10, 2023

US bank deposits have fallen $363 billion since the beginning of March to $17.3 trillion. Where is much of that money going? Into market-market funds, which have risen $304 billion to a record $5.2 trillion.

Video: https://t.co/Olsf1t910j pic.twitter.com/sFDbGqeG3P -

10) Small Cap Blues

— Charlie Bilello (@charliebilello) April 10, 2023

The Ratio of Small Caps to Large Caps is nearing March 2020 levels, which was the lowest we’ve seen since Feb 2001. Over the last 10 years Small Caps have gained 115% (8% annualized) vs. 214% for Large Caps (12% annualized).

Video: https://t.co/Vzx7MkPmrq pic.twitter.com/AheYa89AX4 -

(11) Not Worth the Cost?

— Charlie Bilello (@charliebilello) April 10, 2023

56% of Americans polled by the WSJ said that a four-year college degree was not worth the cost, a record high. Last 30 years: College Tuition has more than quadrupled while overall inflation has a little more than doubled.

Video: https://t.co/WiUdHhWUeB pic.twitter.com/mfiwZSCU4h -

(12) A Bubble of Epic Proportions

— Charlie Bilello (@charliebilello) April 10, 2023

Over the last 20 years, Canadian Home Prices have quadrupled while overall inflation in Canada has increased 49%. This is a bubble of epic proportions.

Video: https://t.co/hjY31NzGvf pic.twitter.com/D5n4lJwpHn -

(13) Fed (unrealized) Losses

— Charlie Bilello (@charliebilello) April 11, 2023

The Fed has over $1 trillion in unrealized losses on their Treasury/MBS holdings.

Video: https://t.co/RAVoWY5ABz pic.twitter.com/qF69cOWwad -

(14) OPEC Bump

— Charlie Bilello (@charliebilello) April 11, 2023

Crude Oil prices jumped back above $80/barrel after OPEC announced it will be cutting output by 1.16 million barrels per day. Prices were as low as $65 just a few weeks ago.

Video: https://t.co/wBU3CRNWlz pic.twitter.com/gNkPUs5uOo -

(15) Alibaba Breakup

— Charlie Bilello (@charliebilello) April 12, 2023

Alibaba bounced after announcing a planned split into six business groups. However, the stock remains over 67% below its 2020 peak. Since $BABA went public in Sep 2014 it has gained just 10% versus a 531% gain for Amazon.

Video: https://t.co/vyUQZ1dyWG pic.twitter.com/OzTY9S2FZf