SEC Oversight Hearing with Gary Gensler

Tune in to the House Financial Services Committee SEC oversight hearing with Gary Gensler today at 10am ET. We'll hear a lot about equity market structure reforms and crypto. Plus, learn about Gensler's clear-cut statement on crypto.

Dave Lauer

Creating @UrvinTerminal at https://t.co/wRGu09xo8l. Advocate for fair markets. Passionate about science & my kids. Believer in @WeTheInvestors_. 🇺🇲 in 🇨🇦

-

There's a House Financial Services Committee SEC oversight hearing today at 10am ET with @GaryGensler testifying. You can watch it here, I'll plan on tweeting out anything interesting/notable.https://t.co/Zff3A3KVHZ

— Dave Lauer (@dlauer) April 18, 2023 -

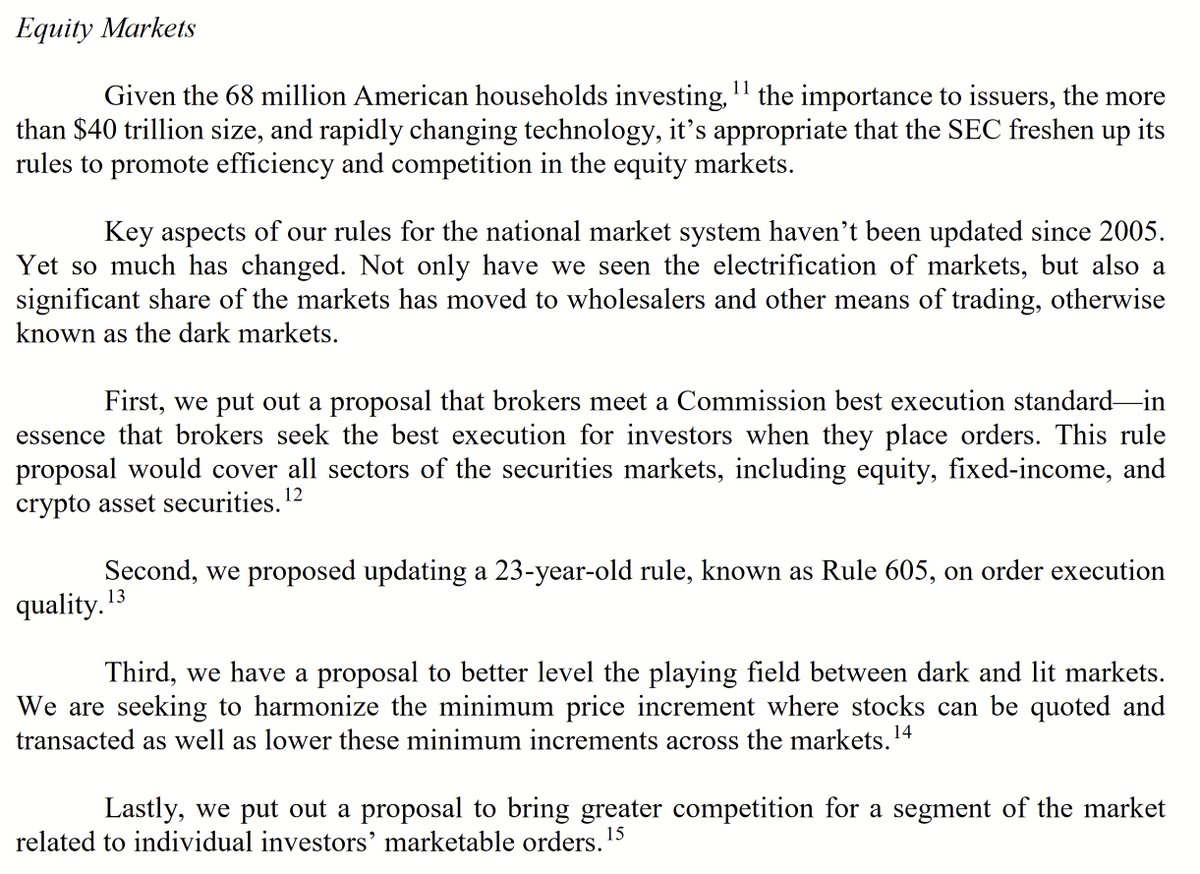

His testimony leads with equity market structure reforms - they're front and center. I think we'll hear a lot about them and crypto today. It'd be easier if members of Congress were forced to wear the logos of their donors though, so you know where the questions come from. pic.twitter.com/wVCyIL2jTZ

— Dave Lauer (@dlauer) April 18, 2023 -

Pretty clear-cut statement here on crypto. Not a surprise given past speeches and present enforcement actions. pic.twitter.com/VOQFU4eVjo

— Dave Lauer (@dlauer) April 18, 2023 -

McHenry is kicking off the hearing, opening statement starts with crypto. Says SEC is punishing crypto firms, and that Congress needs to provide clear rules of the road. This is pretty contradictory - he agrees Congress is needed, so what does he expect from the SEC?

— Dave Lauer (@dlauer) April 18, 2023 -

As McHenry expresses concern about quantity of rule-making, probably worth remembering how much money he takes from Wall St firms. pic.twitter.com/BdH20k3Za5

— Dave Lauer (@dlauer) April 18, 2023 -

Rep Waters starts with a focus on banking stress and debt limit. She expresses concern that the hearing isn't focused on these issues, but "sham investigations... non-stop hearings... to delay or impede the work of the agency... everyday people will pay the price."

— Dave Lauer (@dlauer) April 18, 2023 -

Much criticism of SEC "rushing rules." Rep Waters pointing out that comment periods have been twice as long as legally required, and that most rules have already had hearings, and been under development for years. This is true - equity market rules have been debated for a decade.

— Dave Lauer (@dlauer) April 18, 2023 -

Oh boy, here comes Ann Wagner. She's filed comment letters against SEC rules. "Overly aggressive agenda that is rushing through rulemakings at a frenzied pace." Every time you think the SEC moves slow, think about how the other side sees it! pic.twitter.com/eTkUcA9PUm

— Dave Lauer (@dlauer) April 18, 2023 -

Rep Sherman now giving his intro, thanking Gensler over and over again for investor protection in crypto, climate disclosures and other rulemakings. Quite the contrast so far between Rs and Ds.

— Dave Lauer (@dlauer) April 18, 2023 -

Gensler making his statement - great point that he just made - the most important technology of our day is AI, not crypto, even though that's going to be a main topic of conversation.

— Dave Lauer (@dlauer) April 18, 2023 -

Gensler just took a shot at "market intermediaries" - markets should serve investors and issuers, it shouldn't be the other way around. A lot of market participants (mainly those who make money from trading or intermediation) tend to see it the other way.

— Dave Lauer (@dlauer) April 18, 2023 -

Gensler schooling McHenry on the Commodity Exchange Act. What a way to start the hearing. McHenry doesn't seem to know what the law says and how securities/commodities work.

— Dave Lauer (@dlauer) April 18, 2023

"Is Ether a commodity or security?"

Gensler won't answer the question. -

McHenry pushing Gensler on if the uncertainty around specific crypto protocols being considered a commodity by CFTC and a security by the SEC is a bad thing.

— Dave Lauer (@dlauer) April 18, 2023

Gensler says that there's not uncertainty, and that securities laws apply to securities. We'll hear this answer a lot. -

McHenry asks about equity market structure proposals in the context of whether the comment periods are too short.

— Dave Lauer (@dlauer) April 18, 2023

Gensler: 105 days to comment on those, not short. Average is 70+ days. -

Gensler defining a security based on Howie test, focused on whether public is anticipating a profit from the efforts of others. He will continue to push this point - crypto falls under security laws, and is concerned about mass non-compliance.

— Dave Lauer (@dlauer) April 18, 2023 -

Waters asks - is crypto different from other securities? Does SEC have the tools and authority needed?

— Dave Lauer (@dlauer) April 18, 2023

Gensler says that they have the laws and authority needed to oversee crypto intermediaries, exchanges and issuers. Says SEC has engaged with firms. -

Gensler, speaking about crypto: I've been in and around finance for 40 years and I've never seen a field that is so non-compliant with securities laws.

— Dave Lauer (@dlauer) April 18, 2023 -

French Hill asking questions about stablecoins right now, asking if Congress should draft legislation on stablecoins. Gensler pointing out it's important to not undermine money markets, and fraud/manipulation enforcement. pic.twitter.com/419YzHjA6E

— Dave Lauer (@dlauer) April 18, 2023 -

Rep Hill: I'm not a supporter of the CAT. Has the SEC finalized the rules?

— Dave Lauer (@dlauer) April 18, 2023

Gensler: Not finalized on costs/funding and data security.

This point is one most people don't know - CAT is in operation, but nobody knows who's going to pay for it. -

Responding to a question about SVB, pointing out new SEC rule that would clawback executive comp and bonuses if they were based on fraudulent financials.

— Dave Lauer (@dlauer) April 18, 2023 -

Pete Sessions: If you can't express views that represent the agency, why are you here?

— Dave Lauer (@dlauer) April 18, 2023

Gensler: I speak as Chair of the agency and speak for myself and my views.

Sessions: You should re-evaluate that, it's a cop-out.

Gensler: Uh... this is the law. -

Does anyone have any idea what Sessions is talking about right now?

— Dave Lauer (@dlauer) April 18, 2023 -

Rep Sherman: All intangible investment contracts (aka crypto) are securities - we should pass legislation that says that. Also accredited investor definition should discard idea of wealth and looks instead at knowledge, but which limits % of assets you can invest.

— Dave Lauer (@dlauer) April 18, 2023 -

Rep Sherman: If crypto token is a security, does an exchange that trades these tokens need to register as a national securities exchange?

— Dave Lauer (@dlauer) April 18, 2023

Gensler: Yes. -

Rep Sherman: There are companies calling themselves private that have more than 2k beneficial owners, but hide behind "street name" loophole. That's not what Congress intended.

— Dave Lauer (@dlauer) April 18, 2023

Gensler: I've asked staff to look at this issue and propose a way to close this loophole. -

Rep Lucas: Would SEC rule to disclose large security-based swaps positions harm markets? We wrote bipartisan letter to urge you to aggregate and anonymize this data.

— Dave Lauer (@dlauer) April 18, 2023

Gensler: We are considering your feedback and finalizing the rule. Didn't give any specifics. -

Rep Lucas: CFTC under you was rushed and circumvented rulemaking process with patchwork process. Those rules were req'd by Dodd-Frank though. You're doing the same at the SEC. The SEC should take more care to consider impact of rules, avoid unintended consequences.

— Dave Lauer (@dlauer) April 18, 2023 -

Gensler: I agree, we benefit from public comment, benefit from hearings and interactions. Generally takes over a year to finalize something.

— Dave Lauer (@dlauer) April 18, 2023

Rep Lucas: You've issued twice as many rules as previous SECs, concerned about volume of rules and getting things right. -

Rep Lynch: Don't all of the crypto enforcement actions provide documents & rules for other crypto firms to follow and understand.

— Dave Lauer (@dlauer) April 18, 2023

Gensler: Yes, that's how it works.

Seems like they're both happy w/regulation by enforcement, though GG points out many public statements & rules. -

Quite a strong statement:

— Dave Lauer (@dlauer) April 18, 2023

Gensler: Crypto undermines the $100T capital markets, they've chosen to be non-compliant, that's their business model. -

Lynch asks about co-mingling of functions.

— Dave Lauer (@dlauer) April 18, 2023

Gensler: The NYSE doesn't trade against its customers. We see this all over crypto, and often not disclosed. We've brought a number of enforcement actions. -

Rep Posey: Did you direct staff to look into FTX?

— Dave Lauer (@dlauer) April 18, 2023

Gensler: I directed the staff to look into crypto intermediaries, yes. We filed a number of actions on FTX and SBF in December/January. We found a number of violations of securities laws. -

Rep Posey asking pointed questions about why the SEC didn't do more to protect investors in FTX. Hard for Gensler to address this issue - he says that because they didn't file charges until December they couldn't notify the public.

— Dave Lauer (@dlauer) April 18, 2023 -

This is a point that frustrates so many people - why isn't the SEC out in front of enforcement actions, why aren't they doing more to protect investors? Gensler points out that often investigations don't go anywhere, and it wouldn't be proper to come out publicly earlier.

— Dave Lauer (@dlauer) April 18, 2023 -

Rep Cleaver asking about the debt ceiling. Are you concerned about the threat of not raising it?

— Dave Lauer (@dlauer) April 18, 2023

Gensler: It creates uncertainty, and if it happened it would be "one heck of a mess in capital markets... it would undermine the base of capital markets, the risk free rate." -

Gensler: Going over the debt limit cliff would hurt equity markets, would reduce liquidity in Treasury market which would increase taxpayer costs, it would ripple through other fixed income markets, it would be unprecedented and it would result in stress in the banking system.

— Dave Lauer (@dlauer) April 18, 2023 -

Rep Luetkemeyer: I am concerned (as is the CEO of Schwab) about short-selling given the run on SVB. Foreign actors could instigate a similar type of outcome. Do you have the ability to stop a short sale problem that arises in the banking industry?

— Dave Lauer (@dlauer) April 18, 2023 -

Gensler: We guard against market manipulation and trading on MNPI.

— Dave Lauer (@dlauer) April 18, 2023

Luetkemeyer: Do you have the tools/resources to cut off runs on the bank or raids on a stock?

Gensler: We have the authority to go against fraud.

Do you have authority to ban short selling?

Gensler: No -

Rep Himes concerned about increase of private offerings and size of private market relative to public markets. Individual investors can't invest in these private offerings. I'm concerned about the increasingly small set of opportunities for individual investors.

— Dave Lauer (@dlauer) April 18, 2023 -

Gensler: America has benefited from robust private & public markets. Both have a role to play. We want greater efficiency & competition in the asset management of private capital - $25T of AUM in hedge funds & private equity. Greater transparency of fees, side letters.

— Dave Lauer (@dlauer) April 18, 2023 -

Rep Huizenga is annoyed that SEC response to request for more information on climate disclosure had nearly only public documents. It's embarrassing that this response included a letter from Huizenga congratulating him on becoming SEC chair. Did SEC do analysis on energy costs?

— Dave Lauer (@dlauer) April 18, 2023 -

Gensler: Economic analysis is in the rule proposal. We're not a climate regulator. We looked at over 6k public registration statements.

— Dave Lauer (@dlauer) April 18, 2023 -

Rep Huizenga: Did SEC staff recommend SBF be charged before you charged him?

— Dave Lauer (@dlauer) April 18, 2023

Gensler: We have to keep investigative matters confidential. -

Rep Beatty: Do climate rules affect any private companies? Small businesses?

— Dave Lauer (@dlauer) April 18, 2023

Gensler: No, only for public companies. -

Rep Wagner: If our markets are so great, and things are so good for retail investors, why release the four equity market structure reform proposals? Why completely upend and remake markets from top to bottom? Proposals admit over 100 times that SEC is uncertain over impact.

— Dave Lauer (@dlauer) April 18, 2023 -

Rep Wagner: Why are you willing to risk damaging markets for retail investors? Congress is not willing to take on that risk. Reconsider these proposals. Are you aware there is a process under existing rules to amend/change FINRA's Best Ex Rules?

— Dave Lauer (@dlauer) April 18, 2023

Gensler: Yes. -

Wagner: Do you believe FINRA is incapable of enforcing best ex?

— Dave Lauer (@dlauer) April 18, 2023

Gensler: I think the SEC should have a rule at our level as well.

Wagner: Best Ex would be duplicative, onerous and costly.

Rep Wagner really doesn't want the SEC to have a best ex rule. I wonder why? pic.twitter.com/BSx4lvMKie -

Rep Barr: Forcing banks to include custodied crypto assets on a bank balance sheet has serious implications for bank balance sheets. This means there aren't institutional-grade custody solutions.

— Dave Lauer (@dlauer) April 18, 2023

Gensler: This is important to protect investors, esp in bankruptcy. -

Barr: Did you consult with prudential regulators?

— Dave Lauer (@dlauer) April 18, 2023

Gensler: We consulted with bank regulators and accounting firms.

Barr: It's ironic that nobody at the SEC noticed FTX was run on quickbooks. -

So far there's been almost nothing on the equity market structure rule proposals - this hearing is nearly entirely crypto and climate.

— Dave Lauer (@dlauer) April 18, 2023 -

Rep Foster: Economic analysis with multiple rule makings, and how they interact with one another is a tough thing. I'm a fan of pilot projects - why not try auction trading with 10% of the market to see how it goes? Updating rule 605 is a great answer - but why not produce w/CAT?

— Dave Lauer (@dlauer) April 18, 2023 -

Gensler: 4 proposals address separate, important parts of the market. Updating a 23 year-old rule (605) is important. Auctions proposal will help individual investors get better execution.

— Dave Lauer (@dlauer) April 18, 2023

Foster: Current cockamamie system does allow retail investor to get good price. -

Gensler: I think individual investor is pretty smart, and competition for their orders will improve execution quality.

— Dave Lauer (@dlauer) April 18, 2023

Foster: But why take away ability to monetize small, retail orders?

Gensler: Getting less than midpoint off-exchange shouldn't be allowed. -

Foster: How can you prevent wash trading without knowing true identities of crypto traders?

— Dave Lauer (@dlauer) April 18, 2023

Gensler: We need the intermediaries to register, and then we can get the data from the crypto exchanges themselves. -

Emmer: How many times did you meet with FTX before they collapsed?

— Dave Lauer (@dlauer) April 18, 2023

Gensler: Twice.

Emmer: Do you speak for the SEC when making public statements?

Gensler: I can only speak for myself.

Emmer: How can crypto firms register? You haven't provided any rules for them. -

Gensler: It's a largely non-compliant field.

— Dave Lauer (@dlauer) April 18, 2023

Emmer: Do you need more legislative authority and direction to regulate crypto? Does it concern you that you're driving this industry out of the US?

Gensler: We're trying to drive them into compliance. -

Emmer: China is opening their market to crypto firms because the US isn't welcoming them and providing guidance and rules. SEC rules make no sense for blockchain companies. You've been an incompetent cop on the beat. pic.twitter.com/NNm6WF8jrG

— Dave Lauer (@dlauer) April 18, 2023 -

Note that taking money from Wall St is a bipartisan thing. Gottheimer is giving Gensler a hard time over the amount of rulemaking under his leadership. NJ Dems tend to take a lot of Wall St money. pic.twitter.com/8GjE4H9gWi

— Dave Lauer (@dlauer) April 18, 2023 -

Gensler talking about how robust the comment process is - you can continue to file comments after the deadline, they have meetings with stakeholders, and they average 12-15 months from proposal to final rule.

— Dave Lauer (@dlauer) April 18, 2023 -

Rep Loudermilk: Too many rules, and CAT is a violation of the Fourth Amendment (what?). He wants SEC to need a search warrant to find wrongdoing. He's concerned about CAT security risks - should data be decentralized and held by thousands of firms (aka make it hard to enforce)?

— Dave Lauer (@dlauer) April 18, 2023 -

Gensler: There's risks in both approaches, and is a debate that technologists have often. CAT is important to oversee and surveil markets.

— Dave Lauer (@dlauer) April 18, 2023

Loudermilk: Surveillance? That's what it's for?

uh.... -

Rep Torres: Why not target enforcement on off-shore, deregulated, over-leveraged firms?

— Dave Lauer (@dlauer) April 18, 2023

Torres doesn't understand why retail brokers can't send retail orders off-exchange to wholesalers under new rules.

NY reps (R & D) take a lot of Wall St money too. pic.twitter.com/mYAp0yVVq1 -

Gensler: You're right that US investors are accessing crypto on-shore and off-shore. Our jurisdiction extends off-shore if US investors are involved. It takes much longer, it's much more challenging to get subpoenas complied with.

— Dave Lauer (@dlauer) April 18, 2023 -

Gensler: Our proposal on retail marketable orders says brokers can accept midpoint trades off-exchange, but otherwise orders need to be sent to competitive facility. We're getting feedback on it. We've gotten 5k+ comments (most are supportive and @WeTheInvestors_ supporters).

— Dave Lauer (@dlauer) April 18, 2023 -

I think this take on Ethereum from @matt_levine on this exchange between McHenry and Gensler is the correct one. Hard to imagine the SEC doesn't consider Ethereum to be a security, but it might be too late for that? pic.twitter.com/nRP8Sr2xjt

— Dave Lauer (@dlauer) April 19, 2023