The J Curve of Startup Investing

Understand the J Curve of startup investing and how to accept write-offs. Learn how to break the spiral of self-doubt and how to get back on track with your investments.

Rahul Mathur

Now: Building @Insurance_Dekho Earlier: Founder @VerakInsurance (YC W21; acquired) Hiring for Eng, Marketing, Sales & Ops roles

-

Many first time startup investors are seeing their first write-offs due to the funding crunch right now.

— Rahul Mathur (@Rahul_J_Mathur) March 30, 2023

Losing money is never easy to accept - you get caught in a spiral of “why did I?” or “what did I miss?” or “what if?” etc… -

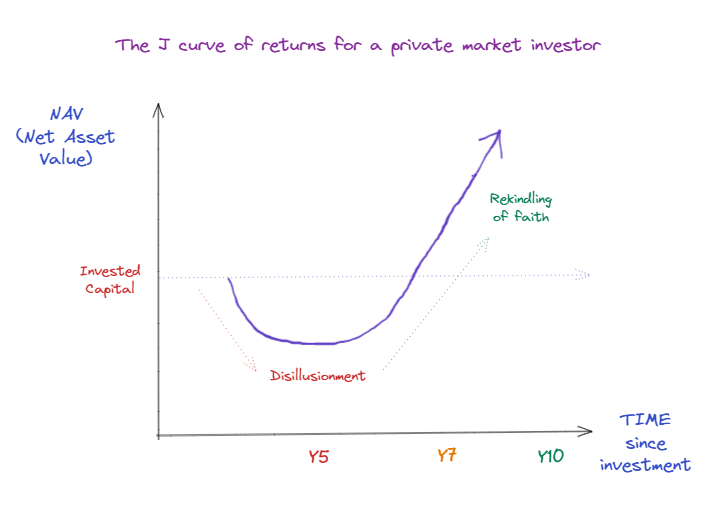

However, if you’re a startup investor who has written off an investment - this isn’t a bug - this is a feature of startup investing called the “J Curve”

— Rahul Mathur (@Rahul_J_Mathur) March 30, 2023

Let me explain this with a simple example: pic.twitter.com/dkughp3OxR -

1. I have invested into 10 startups with avg ticket size of ~ ₹1.5L over the past 3 years

— Rahul Mathur (@Rahul_J_Mathur) March 30, 2023

- This forms a “vintage” i.e. a cohort of investments made at a similar time period

2. In Y2 - 2 companies hit 0

3. In Y3 - another 2 companies hit 0 pic.twitter.com/WhRGI8hjIL -

4. Me: “Holy s*** - what is going on?”

— Rahul Mathur (@Rahul_J_Mathur) March 30, 2023

5. In Y5 - Company #6 returns 1x your investment i.e. ₹1.5L

6. Me: “Bhai paise voh vapis mil gaye”

7. In Y6 - Company #5, #7 and #8 also shut down returning a small amount of money each -

8. In Y7 - Company #9 returns 15x your investment i.e. ₹22.5L

— Rahul Mathur (@Rahul_J_Mathur) March 30, 2023

9. In Y10 - Company #10 returns 75x your investment i.e. ₹112.5L

At the end of this vintage you made 1.5 + 22.5 + 112.5 = ₹136.5 i.e. 9.1x your gross investment over a 10 year period (25% CAGR) which is terrific… -

But, until Y7 - your faith would be rock bottom since you’ve seen multiple failures - BUT this is part of Power Law distribution of outcomes in Venture Capital i.e.

— Rahul Mathur (@Rahul_J_Mathur) March 30, 2023

(a) All investments which don’t succeed - wind up quickly within 2-3 years resulting in write offs -

(b) the few which succeed - pan out over 7 to 10 years & often are hiding in plain sight for several foundational years

— Rahul Mathur (@Rahul_J_Mathur) March 30, 2023

This is why NAV (Net Asset Value) of private market portfolio will follow a J shape - initial losses followed by a spike which returns principal + profits -

Note: All values are for illustrative purposes only.

— Rahul Mathur (@Rahul_J_Mathur) March 30, 2023

I have looked only at “Cash” returns versus unrealized “mark up” returns (which brings another risk of an “reverse N” shape curve due to instances of late stage write-offs such as GoMechanic) -

Don’t lose faith in your ability early - almost every private market investor has marked down (if not written off) investments made across ALL periods (this bull run & previously as well).

— Rahul Mathur (@Rahul_J_Mathur) March 30, 2023

Trust The Process :) But, rewards aren't guaranteed