Inflation Continues to Cool

Core and headline inflation have both decreased over the past year, with core inflation now at 5.3% and headline inflation at 4.0%. This article looks at the causes of this cooling and how it reflects a year ago.

Justin Wolfers

Professor @UMichEcon & @FordSchool | Senior Fellow @BrookingsInst & @PIIE | Intro Econ textbook author | Think Like an Economist podcast.

-

INFLATION IS CONTINUING TO COOL.

— Justin Wolfers (@JustinWolfers) June 13, 2023

Core inflation was 0.4% in May (meeting expectations), and is 5.3% over the year (down from a peak of 6.6%)

Headline inflation rose 0.1% last month (slightly below consensus) and is up only 4.0% over the year (down from a peak of 8.9%) -

The year-ended inflation rates (both core and headline) are falling at a pretty rapid clip. But realize, that reflects a lotta what happened a year ago. The sharp rise in prices 13 months ago "fell out" of the 12-month-ended rate, and this explains a lot of what happened.

— Justin Wolfers (@JustinWolfers) June 13, 2023 -

The big gap between headline inflation (4%) and core (5.3%) -- as well as their different trajectories -- largely reflects the sharp drop in energy prices, which are down 11.7% over the past year.

— Justin Wolfers (@JustinWolfers) June 13, 2023 -

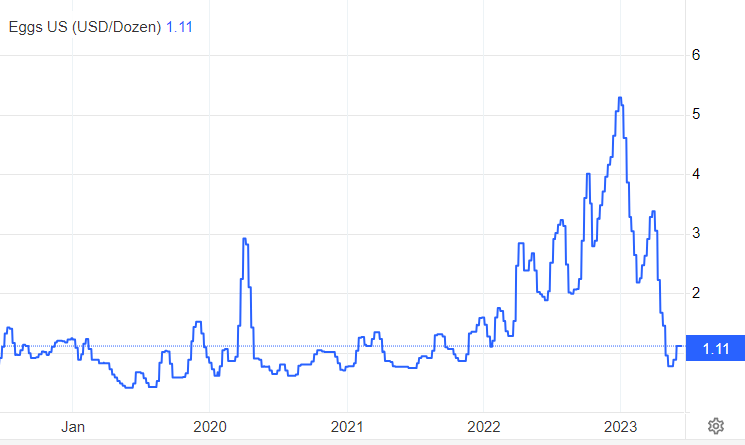

EGGFLATION CRACKED

— Justin Wolfers (@JustinWolfers) June 13, 2023

"the index for eggs fell 13.8 percent, the largest decrease in that index since January 1951."

Good news: Wholesale egg prices have fallen even more sharply, and more price cuts are on the way. pic.twitter.com/jYrLzAB8Mv -

Shelter prices in this inflation report were right on market expectations, and they grew pretty quickly (0.6% over the month, 8.1% over the year).

— Justin Wolfers (@JustinWolfers) June 13, 2023

Good news: We're pretty confident this will decline in coming months. (Rent in new leases tends to lead all total rent indices.) pic.twitter.com/LTZX302LvB -

The CPI is sufficiently closely watched that the extra decimal places matter. And core CPI was +0.44% in May (consensus was 0.4%), so if anything it's somewhat worse than meets the eye.

— Justin Wolfers (@JustinWolfers) June 13, 2023 -

Don't be too distracted by the low headline inflation print.

— Justin Wolfers (@JustinWolfers) June 13, 2023

Core inflation has run at a monthly rate of 0.4% for each of the past six prints.

Pretty clear it's not rising; pretty clear it's not falling; pretty clear it's above the Fed's target. -

Future inflation looks like a race between:

— Justin Wolfers (@JustinWolfers) June 13, 2023

One-off price spikes receding into the rearview mirror (cars, rent, gas, eggs, etc)

v.

A hot economy supporting broad price rises

The former is evident in headline inflation; the latter in core.

Shelter inflation is the one to watch. -

One to watch: The price of confidential government documents is expected to decline sharply due to a sudden supply glut.

— Justin Wolfers (@JustinWolfers) June 13, 2023 -

A simple test of how credible your favorite econ sources are: Are they switching from emphasizing headline inflation to core (or visa-versa) in ways that just happen to fit a preferred narrative?

— Justin Wolfers (@JustinWolfers) June 13, 2023

If so, they're not trying to inform you, they're trying to persuade you.