The Great Monetary Tightening Cycle

Read about the great monetary tightening cycle to combat inflation by slowing growth and wringing out the previous excess. Learn about the balance sheet reduction, liquidity removal, and MBS reduction. Read this blog to learn more!

Sven Henrich

Founder: NorthmanTrader. Financial Market Strategist. Macro & Technical Analysis. Keeping it real. Subscribe: https://t.co/rmRFFvMRaH…

-

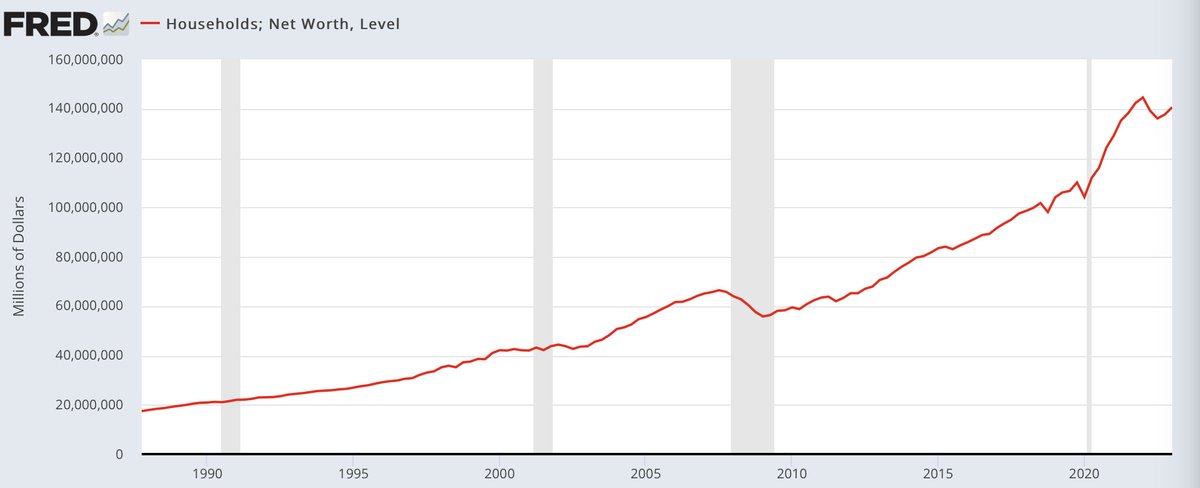

And thus concludes the great monetary tightening cycle to combat inflation by slowing growth & wringing out the previous excess.

— Sven Henrich (@NorthmanTrader) June 12, 2023

Note: Q1 data. pic.twitter.com/cqP6JuzbXc -

After all we reduced the balance sheet by a stunning 7% back all the way to levels of September 22, 2021.

— Sven Henrich (@NorthmanTrader) June 12, 2023

So much tightening. So much liquidity removal. pic.twitter.com/ZG4B1vtzTE -

And look at MBS, we reduced these all the way back to November 2021 levels. pic.twitter.com/4k1qzyD44e

— Sven Henrich (@NorthmanTrader) June 12, 2023 -

Fact is very little excess has been removed at this stage. M2, despite what some call a historic reduction, remains catapulted far above the pre-Covid highs. pic.twitter.com/4C1A3PSnUa

— Sven Henrich (@NorthmanTrader) June 12, 2023 -

In lieu of lag effects of rate hikes having fully manifested themselves yet the great tightening cycle has so far been an illusion as the system remains flush with historic liquidity with half a trillion dollars added this year:https://t.co/Lw4Fx9wI3o

— Sven Henrich (@NorthmanTrader) June 12, 2023 -

And now the Fed wants to pause with the next FOMO greed liquidity driven market in full gear & loose financial conditions all around them.

— Sven Henrich (@NorthmanTrader) June 12, 2023

And if this doesn't get us to our inflation target we don't know what will.

Please. https://t.co/Yd5bu8bXWo