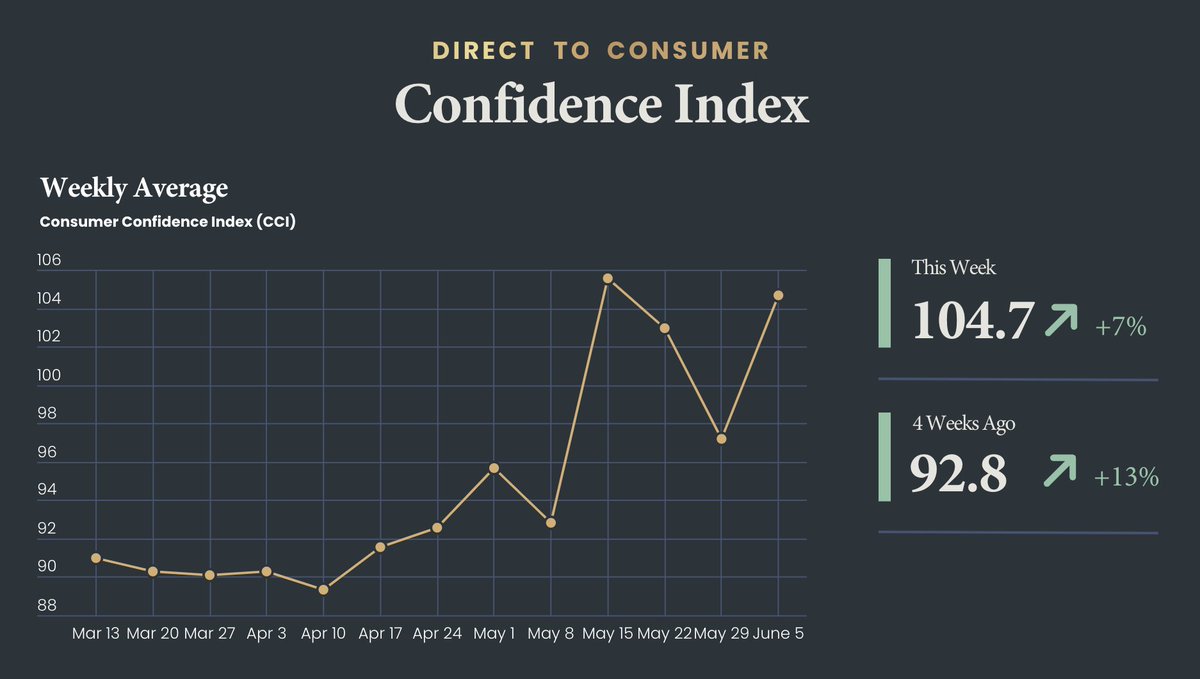

The Direct To Consumer Confidence Index

The Direct To Consumer Confidence Index is the only realtime macro economic indicator built specifically for DTC. It measures the underlying factor in eCommerce performance, giving a better understanding of the economic outlook for the industry.

Taylor Holiday

Follow for insights from a 🏔mountain of eCommerce 📊data Agency CEO https://t.co/P2SGpbrqS5 Brand Partner https://t.co/HPP7oDqTy0 Software Founder https://t.co/deDUAEqJcE DM's open!

-

The biggest underlying factor in eCommerce performance is something none of us could measure.... until now.

— Taylor Holiday (@TaylorHoliday) June 15, 2023

Introducing The Direct To Consumer Confidence Indexhttps://t.co/fqLz9DAYLq

The only realtime macro economic indicator built specifically for DTC

Let me explain... pic.twitter.com/9n3nfJ1T8n -

Last July, we experienced one of the worst month's in eCommerce performance in my 13 years of running CTC.

— Taylor Holiday (@TaylorHoliday) June 15, 2023

It was rough.

iOS impact was heavy and the inflation hysteria was at peak hype cycle. -

The economic outlook was so negative that a measure called "The Consumer Confidence Index" reached an ALL TIME LOW in the 60 year history of its measurement. pic.twitter.com/eN71OnDcE8

— Taylor Holiday (@TaylorHoliday) June 15, 2023 -

In reading these headlines our VP of Paid Media @tonychoPPC asked @RSteveData to begin to explore if any of these macro indicators; gas prices, stock market, CPI, or CCI had any relationship to the performance of our brands.

— Taylor Holiday (@TaylorHoliday) June 15, 2023 -

So Steve got to work on the hypothesis.

— Taylor Holiday (@TaylorHoliday) June 15, 2023

In looking at all the measures Steve found that the consumer confidence index correlated incredibly well with MER (Marketing efficiency rating).

This was an ah ha moment for us. pic.twitter.com/PrD7KMB13t -

The consumer confidence index is a survey of 5,000 people, done by phone, once a month to ask them about their plans to spend in the coming months and their feelings about the overall economy.

— Taylor Holiday (@TaylorHoliday) June 15, 2023 -

It is an incredibly rich, historical measure of how consumers view the world that goes back a really long time!

— Taylor Holiday (@TaylorHoliday) June 15, 2023

But it has one MAJOR limitation...

IT LAGS!!! -

They publish 1 single data point and the data isn't reconciled until almost two weeks after the close of the previous month.

— Taylor Holiday (@TaylorHoliday) June 15, 2023

That makes the data very hard to action against.

Additionally, the limited number of data points makes building predictive models challenging. -

It was clear to me the system was do for modernization.

— Taylor Holiday (@TaylorHoliday) June 15, 2023

I had been thinking hard about how we could possibly recreate the process and thats when it hit me....@JeremiahPrummer's beautiful curly headed profile pic right there in my twitter feed.@KnoCommerce is the solution! -

Kno Commerce powers over 250,000 survey responses EVERY SINGLE DAY across almost 3000 stores.

— Taylor Holiday (@TaylorHoliday) June 15, 2023

They are the perfect partner to enable this data collection.

So of course, I sent him a DM.

All good things start in the DM's pic.twitter.com/qzdmdswEcD -

He jumped at the opportunity and immediately we were off and running.

— Taylor Holiday (@TaylorHoliday) June 15, 2023

Kno's tools allowed us to instantly create a survey, asking similar questions as the Consumer Confidence index.

Here's a little demo: https://t.co/ApuRXWRIbA pic.twitter.com/pO1MDrOLcK -

Next we needed brands opted in to delivering the survey to start gathering data.

— Taylor Holiday (@TaylorHoliday) June 15, 2023

We put together a webinar for CTC x Kno customers and walked through the idea... pic.twitter.com/0rLUPNVM5b -

They were in!

— Taylor Holiday (@TaylorHoliday) June 15, 2023

So on March 13th we started gathering data. -

As the responses come in they are stored and analyzed by @rstevedata to begin creating a model for our "score".

— Taylor Holiday (@TaylorHoliday) June 15, 2023

The model is built using Lasso Regression that takes into account all of the survey results AND the MER that we reported in Statlas. -

This is the key way in which our index differs from the consumer confidence index, it is anchored to actual performance data.

— Taylor Holiday (@TaylorHoliday) June 15, 2023

This allows us to build a bridge between consumer sentiment and DTC performance with the goal of making the present DTCCI score predictive of future MER. -

So, the 104.7 you see in THIS WEEKS score is how confident consumers feel about spending their money in the near future (next week).

— Taylor Holiday (@TaylorHoliday) June 15, 2023

That number SHOULD BE predictive of MER that we will report next week. -

So how have the early results been? Well, so far the DTCCI and MER have 0.95 correlation. 🤯

— Taylor Holiday (@TaylorHoliday) June 15, 2023 -

Last week we predicted that MER would come in at 6.06 and it landed at 5.96.

— Taylor Holiday (@TaylorHoliday) June 15, 2023

CCI looks good this week (104.7) which should look good for a good MER (6.39) next week. pic.twitter.com/m3YIZ5Chaa -

Now it is important to acknowledge that it is still very early in this research project and there is danger of overfitting the model in these early days but the results are exciting so far.

— Taylor Holiday (@TaylorHoliday) June 15, 2023 -

We are currently collecting about 6500 responses a month and our goal is to get to 5000 a DAY by the end of the year.

— Taylor Holiday (@TaylorHoliday) June 15, 2023

This would give us the same representative sample that the existing CCI collects every month, EVERY. SINGLE. DAY. -

So how can you use this metric right now? Here are some ways we are playing with it....

— Taylor Holiday (@TaylorHoliday) June 15, 2023 -

1. A pulse check in moments of poor performance or extreme performance. Is there a macro affect we aren't seeing?

— Taylor Holiday (@TaylorHoliday) June 15, 2023

2. An input in our forecasting models for spend/cac and overall revenue.

3. A data visualization for customers looking to understand the broader context -

Bookmark the site and sign up for alerts and we'll make sure we can add visibility to the broader market sentiment to your arsenal.

— Taylor Holiday (@TaylorHoliday) June 15, 2023

And if you want to be involved project heres how you can get involved. -

First, sign up for https://t.co/LfElFCMJKM and ask to add the survey to your site.

— Taylor Holiday (@TaylorHoliday) June 15, 2023

Or just DM @jeremiahprummer All participating brands will have first access to v2 which will include individual brand scores and predictive modeling for your individual customers. -

Second, sign up for @RSteveData 's newsletter at: https://t.co/IZO5Pjdgwv

— Taylor Holiday (@TaylorHoliday) June 15, 2023

He is going to be including the index and predictive MER results weekly alongside the other industry data we analyze. -

Finally if you are interested in contributing to the model development or curious about access to the raw data for your own research and modeling we are considering the development of an API to share with other research and investment firms. DM me directly for that opportunity.

— Taylor Holiday (@TaylorHoliday) June 15, 2023 -

What people believe tells us a lot about how they will behave and this index is a portal into the minds and feelings about the customers we all seek to serve.

— Taylor Holiday (@TaylorHoliday) June 15, 2023

We hope it becomes a useful tool for our industry and continues to compound in value over time! -

It would mean the world to me, @JeremiahPrummer, @RSteveData and the entire @commonthreadco and @KnoCommerce teams if you would like, RT and share this with someone you know!

— Taylor Holiday (@TaylorHoliday) June 15, 2023

I appreciate the support and enjoy following allow.

Here's to better vibes and higher MER! -

If you enjoyed this content in written form, you will probably like the audio format event more:

— Taylor Holiday (@TaylorHoliday) June 16, 2023

Check out our podcast "The eCommerce Playbook" for more.https://t.co/w0JsFApGdH