The Story of “Crazy Eddie” and Eddie Antar

Bernie Madoff ran his fraud for 17 years, but Eddie Antar was not caught for almost 30 years. Learn the story of how Eddie Antar founded his consumer electronics retailer, Sight and Sound, and how his lack of funds led to creative solutions.

Kurtis Hanni

I decode business finances for SMB owners and leaders. Join 20k learning finance concepts every Thursday: https://t.co/OxWSQCNxfS

-

Bernie Madoff ran his fraud for 17 years,

— Kurtis Hanni (@KurtisHanni) April 11, 2023

but this fraudster wasn’t caught for almost 30 years.

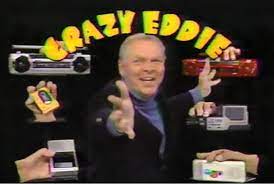

Here is the story of “Crazy Eddie” and Eddie Antar: pic.twitter.com/IOCxI2txWY -

In 1969, Eddie Antar founded his consumer electronics retailer, Sight and Sound, with his father and cousin.

— Kurtis Hanni (@KurtisHanni) April 11, 2023

Eddie became known for his aggressive selling tactics and was given the nickname "Crazy Eddie."

When he became the majority owner, he changed the store's name to match. pic.twitter.com/MUJniD1Arp -

Lack of funds = creativity

— Kurtis Hanni (@KurtisHanni) April 11, 2023

Early on, Eddie couldn’t afford to run TV ads, so he partnered with a local radio disc jockey to run radio ads instead.

The ads had a very particular style to them, ending with “OUR PRICES ARE INSAAAAANE.” pic.twitter.com/yjBfbXcHtS -

They eventually created TV ads, running them overnight to get cheaper slots.

— Kurtis Hanni (@KurtisHanni) April 11, 2023

The ads were a hit and helped them grow to over 40 stores with more than $300 million in sales at their peak.

Watch the ads here: https://t.co/AIc1sFR1Pn -

But things were never as they seemed.

— Kurtis Hanni (@KurtisHanni) April 11, 2023

From very early on, Crazy Eddie was not being run above board.

They:

1. Collected sales tax, but didn’t pay it

2. Paid workers in cash to avoid payroll taxes

3. Claimed old & previously claimed inventory to overstate insurance losses -

In 1980, the desire for continued growth meant they needed to go public.

— Kurtis Hanni (@KurtisHanni) April 11, 2023

But, they were skimming profits, thus making them appear minimally profitable. -

Eddie’s nephew Sam Antar, was made CFO and stopped profit skimming.

— Kurtis Hanni (@KurtisHanni) April 11, 2023

This took profits from $1.7 million in 1980 to $8 million in 1984.

No one knew… but they stopped defrauding the IRS to start defrauding Wall Street. pic.twitter.com/H12iptKElL -

In September 1984, the initial public offering sold shares for $8.

— Kurtis Hanni (@KurtisHanni) April 11, 2023

In 1985 same store sales went up 20%, so the stock shot up to almost $80/share.

But then same-store sales were only up 4% in Jan/Feb 1986, where the target was 10%. -

The difference between these numbers was about $2.2 million.

— Kurtis Hanni (@KurtisHanni) April 11, 2023

To cover for this, they came up with the “Panama Pump.”

Eddie took his previously skimmed money and deposited it into the business as sales to cover the difference. -

This kept the stock high and the Antar’s used this to their benefit, selling over $20 million in stock shortly thereafter.

— Kurtis Hanni (@KurtisHanni) April 11, 2023

Eventually, they pocketed over $90 million (equivalent to $240 million today) from the sale of stocks. -

But the highs of 1986 were short-lived.

— Kurtis Hanni (@KurtisHanni) April 11, 2023

Store sales started to slow as increased competition and prices of consumer electronics put pressure on the business.

To keep the fraud going they tried everything: -

- Convinced a vendor, Wren, to help them inflate inventory ($5-10 million)

— Kurtis Hanni (@KurtisHanni) April 11, 2023

- Faked in-store inventory numbers (knowing auditors couldn't check them all)

- Wined & dined the auditors

- Generated over $20 million of phony debit memos (understating AP & overstating income) -

Despite all of this, they still had to report losses.

— Kurtis Hanni (@KurtisHanni) April 11, 2023

By May 1987, the stock had plummeted to $5/share.

To make bad times worse, 2 different events spelled doom for Crazy Eddie:

- Eddie fired 2 long-time employees

- The lower stock price made them a hostile takeover target -

The employees went to the SEC to report the fraud and only revealed Eddie’s involvement in the fraud.

— Kurtis Hanni (@KurtisHanni) April 11, 2023

Then, in Nov 1987, Elias Zinn bought the company and removed the Antar’s from their leadership roles.

Zinn soon found over $40 million in inventory shortages. -

Eddie fled to Israel, but eventually went to prison.

— Kurtis Hanni (@KurtisHanni) April 11, 2023

Only 3 of the Antar’s were arrested and put on trial, despite many more being involved. pic.twitter.com/agEtLh7Z0j -

In the end, Eddie only spent 4 years in prison and paid more than $120 million in fines and restitution.

— Kurtis Hanni (@KurtisHanni) April 11, 2023

Most of it from secret bank accounts around the world.

Eddie passed away in 2016 at the age of 68. -

The story of Eddie Antar & Crazy Eddie is a crazy one.

— Kurtis Hanni (@KurtisHanni) April 11, 2023

It’s also a great example of how to protect against fraud:

1. Segregation of duties

2. Review transaction-level data

3. Internal & External audits

4. Validate inventory

5. Culture of integrity -

I share a few more ways in my last newsletter.

— Kurtis Hanni (@KurtisHanni) April 11, 2023

You can check it out below.

Join 15k+ and subscribe while you’re at it:https://t.co/8NUhUcYNGP -

Thanks for reading!

— Kurtis Hanni (@KurtisHanni) April 11, 2023

If you want to learn more, check out "Retail Gangster" by Gary Weiss.

If you enjoyed this thread:

1. Follow me @KurtisHanni for more of these

2. RT the tweet below to share this thread with your audiencehttps://t.co/O3orFDBKcq -

Are you and entrepreneur or business leader?

— Kurtis Hanni (@KurtisHanni) April 11, 2023

Financial literacy is one of the most important skills you can learn.

Each Thursday I teach 1 financial concept to 15,000+ on my newsletter.

Join here: https://t.co/w3QuDNKTY7