Introducing Taker Fees to the Osmosis DEX

Osmosis will be introducing taker fees to the Osmosis DEX, emphasizing the importance of capturing volume relative to TVL. Historically, Osmosis has been measured by the amount of liquidity deposited via it's various liquidity pools versus the volume generated.

Osmosis 🧪

For support ➡️ https://t.co/mBuwxWtLTe

-

In the past, spot exchanges have utilized two types of fees: maker and taker fees.

— Osmosis 🧪 (@osmosiszone) June 19, 2023

This has allowed them to benefit from the activity on the platform.

Osmosis will be introducing taker fees to the Osmosis DEX, emphasizing the importance of capturing volume relative to TVL. 🧵 pic.twitter.com/c9GWKLELbl -

1/ Historically, Osmosis has been measured by the amount of liquidity deposited via it's various liquidity pools versus the volume generated.

— Osmosis 🧪 (@osmosiszone) June 19, 2023

Liquidity providers earned rewards both in the form of incentives and swap fees.

This model has been key for bootstrapping liquidity. pic.twitter.com/igjOnZFrAF -

2/ However, change is on the horizon with the introduction of several upgrades, including:

— Osmosis 🧪 (@osmosiszone) June 19, 2023

- Supercharged Liquidity: This brings unparalleled efficiency to liquidity providers.

- OSMO 2.0: Updated tokenomics.

And now, we have the introduction of taker fees. -

3/ What exactly are taker fees? 🤔

— Osmosis 🧪 (@osmosiszone) June 19, 2023

Taker fees are the fees incurred when making a swap and are reflected on the displayed swap fees.

It's important to note that taker fees differ from maker fees, which are the fees charged to liquidity providers. -

4/ Why introduce taker fees?

— Osmosis 🧪 (@osmosiszone) June 19, 2023

As we prepare for the migration to supercharged liquidity, which should have a positive impact on the amount of fees generated relative to the liquidity depth.

Osmosis will need a usage-based way to secure the network and fund the Community pool. https://t.co/VzL58tTB0E -

5/ The Proposal:

— Osmosis 🧪 (@osmosiszone) June 19, 2023

A taker fee for swaps will be introduced with a flat rate based on the input value, regardless of the underlying pool's LP swap fee (to be renamed as spread factor).

The suggested default rate for all pools is 0.15%. ( adjustable by governance) 🏛 -

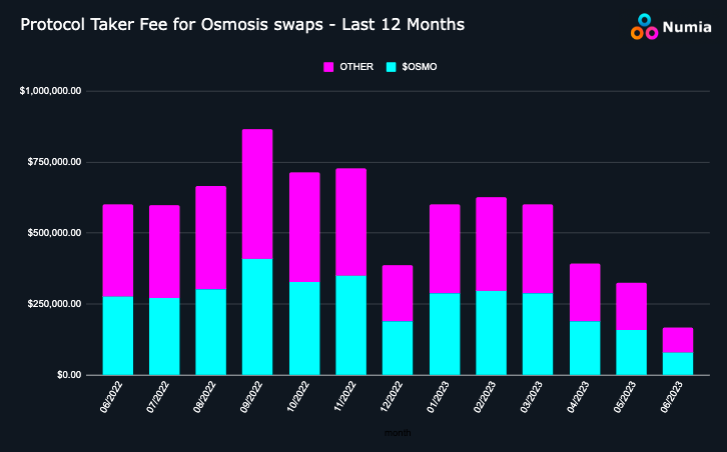

6/ How beneficial could this have been if previously implemented?

— Osmosis 🧪 (@osmosiszone) June 19, 2023

According to @NumiaData, Osmosis has seen a total volume of $4.7 billion on Osmosis in the past year (post Terra).

This volume would have generated $7.13 million over the last 12 months in taker fees. https://t.co/Djb6XvSRZJ -

7/ By implementing a taker fee, the overall swap fee for existing pools effectively increases.

— Osmosis 🧪 (@osmosiszone) June 19, 2023

As concentrated liquidity and order books become more prevalent, it is projected that swap fees for most pools will be lower than the current rates. -

8/ Introducing Flexibility to Osmosis:

— Osmosis 🧪 (@osmosiszone) June 19, 2023

Osmosis could introduce programs in the future to enable users to decrease trading fees, for example:

- VIP programs

- Discounts based on $OSMO staked

- Referral systems

- Fee rebates

Bringing us closer to competing with CEXs -

9/ The introduction of taker fees had overwhelming support from the Osmosis community.

— Osmosis 🧪 (@osmosiszone) June 19, 2023

74% of whom voted in favor of this proposal. pic.twitter.com/PFDla2NMiO -

10/ The passing of this proposal brings us closer to finalizing the upgrades Osmosis has been undergoing for the past few months.

— Osmosis 🧪 (@osmosiszone) June 19, 2023

With the introduction of supercharged liquidity, OSMO 2.0, and taker fees, Osmosis is focused on enhancing efficiency and sustainability.