Introducing CALC Finance to Osmosis

This blog post introduces CALC Finance to Osmosis, a fully decentralized suite of tools to level up your trading game. It looks at their mission in DeFi and the amazing strategies that CALC Finance brings to Osmosis.

Osmosis 🧪

For support ➡️ https://t.co/mBuwxWtLTe

-

Introducing @CALC_Finance to Osmosis: a fully decentralized suite of tools to level up your trading game!

— Osmosis 🧪 (@osmosiszone) June 11, 2023

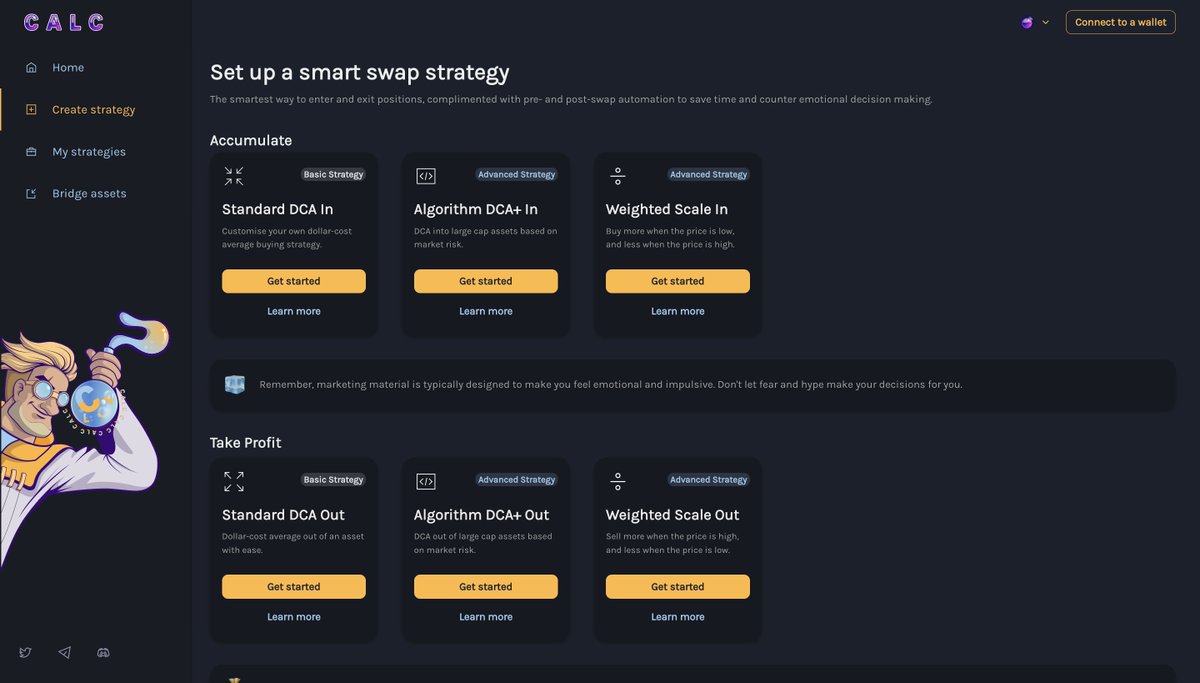

With CALC, you can execute a variety of advanced strategies like DCA in/out, weighted scale swaps, and their newest innovation - Algorithmic DCA+.

Let's break it down. 🧵 pic.twitter.com/MIL083B6ZQ -

1/ Before diving into the amazing strategies that @CALC_Finance brings to Osmosis, it's important to understand their mission in DeFi.

— Osmosis 🧪 (@osmosiszone) June 11, 2023

They aim to enable equal opportunity and access through a suite of decentralized tools that empower users to make the smartest swaps possible. pic.twitter.com/ND5pEUz7DI -

2/ Their product is focused on countering emotional decision-making by introducing automated strategies, such as:

— Osmosis 🧪 (@osmosiszone) June 11, 2023

- Custom DCA In/Out

- Weighted Scale In/Out

- DCA+

- Custom swap intervals

- Generate Yield

- Reinvest

Let's dig deeper into each strategy 👇 pic.twitter.com/DmlTFghXPK -

3/ 1️⃣ Custom DCA In/Out 📊

— Osmosis 🧪 (@osmosiszone) June 11, 2023

With this feature, you can create a set of fully customizable strategies to enter or exit a position over a period of time.

It's easy to use: just select the asset you wish to enter/exit, choose the time strategy, the amount, and you're ready to go! pic.twitter.com/h3Qs4jUrun -

4/ 2️⃣ Weighted Scale In/Out ⚖

— Osmosis 🧪 (@osmosiszone) June 11, 2023

What if you wanted to select a strategy that allows you to buy more of an asset as the price decreases and sell more of it as it increases?

Weighted Scales allow you to do just that by taking advantage of the volatility in crypto assets. pic.twitter.com/LTGDEkSMUk -

5/ 3️⃣ DCA+ 🤖

— Osmosis 🧪 (@osmosiszone) June 11, 2023

This AI-powered tool takes the guesswork out of setting up strategies by using machine learning algorithms to optimize them.

By scanning a variety of market metrics and introducing a risk factor for each asset, users can enjoy better performance. pic.twitter.com/eyp35S5O6i -

6/ 4️⃣ Custom Swap Intervals ⌛

— Osmosis 🧪 (@osmosiszone) June 11, 2023

This newly introduced strategy gives you even more control over when to make swaps on Osmosis.

Allowing users to customize the swaps to occur every minute or every week, it's up to you to set the intervals. pic.twitter.com/Pe0CRlmq90 -

7/ 5️⃣ Generate Yield 🧪

— Osmosis 🧪 (@osmosiszone) June 11, 2023

Built on Osmosis, CALC has the ability to take advantage of the entire ecosystem of DeFi products.

For example, users can have the output of their DCA+ strategy auto-lent on @mars_protocol to immediately start earning yield https://t.co/fsvLTtInLD -

8/ 6️⃣ Reinvest 🔁

— Osmosis 🧪 (@osmosiszone) June 11, 2023

This strategy takes customization to the next level by allowing users to feed the output of one strategy into another.

Strategy-ception 🤯

This maximizes DeFi composability while giving users even more options. pic.twitter.com/i7e3N2cqMH -

9/ The Osmosis community has warmly welcomed the launch of @CALC_Finance, praising its innovative tooling and user-friendly framework.

— Osmosis 🧪 (@osmosiszone) June 11, 2023

CALC has powered over 2,100 strategies, generating an impressive $1.3M in volume. pic.twitter.com/UeDNsPJqqS -

10/ Missed the live chat with @CALC_Finance on UTFL? No sweat. Catch up on their upcoming launch and Osmosis integration here:

— Osmosis 🧪 (@osmosiszone) June 11, 2023

Listen now 👉 https://t.co/ywk8Od9cmT -

11/ Be sure to visit @CALC_Finance to stay up to date on their latest developments and announcements.

— Osmosis 🧪 (@osmosiszone) June 11, 2023

👉Set your next strategy: https://t.co/2Sj9rXnG1j